After-sales service is an increasingly important aspect of manufacturers’ success – and achieving service parts pricing maturity is a critical way for manufacturers to meet margin and revenue goals in a new servitization-driven environment. However, the complexity of service parts planning, as well as the many locations, channels and distribution levels at which those parts are priced, requires a wide range of pricing approaches to suit the various needs of original equipment manufacturers (OEMs).

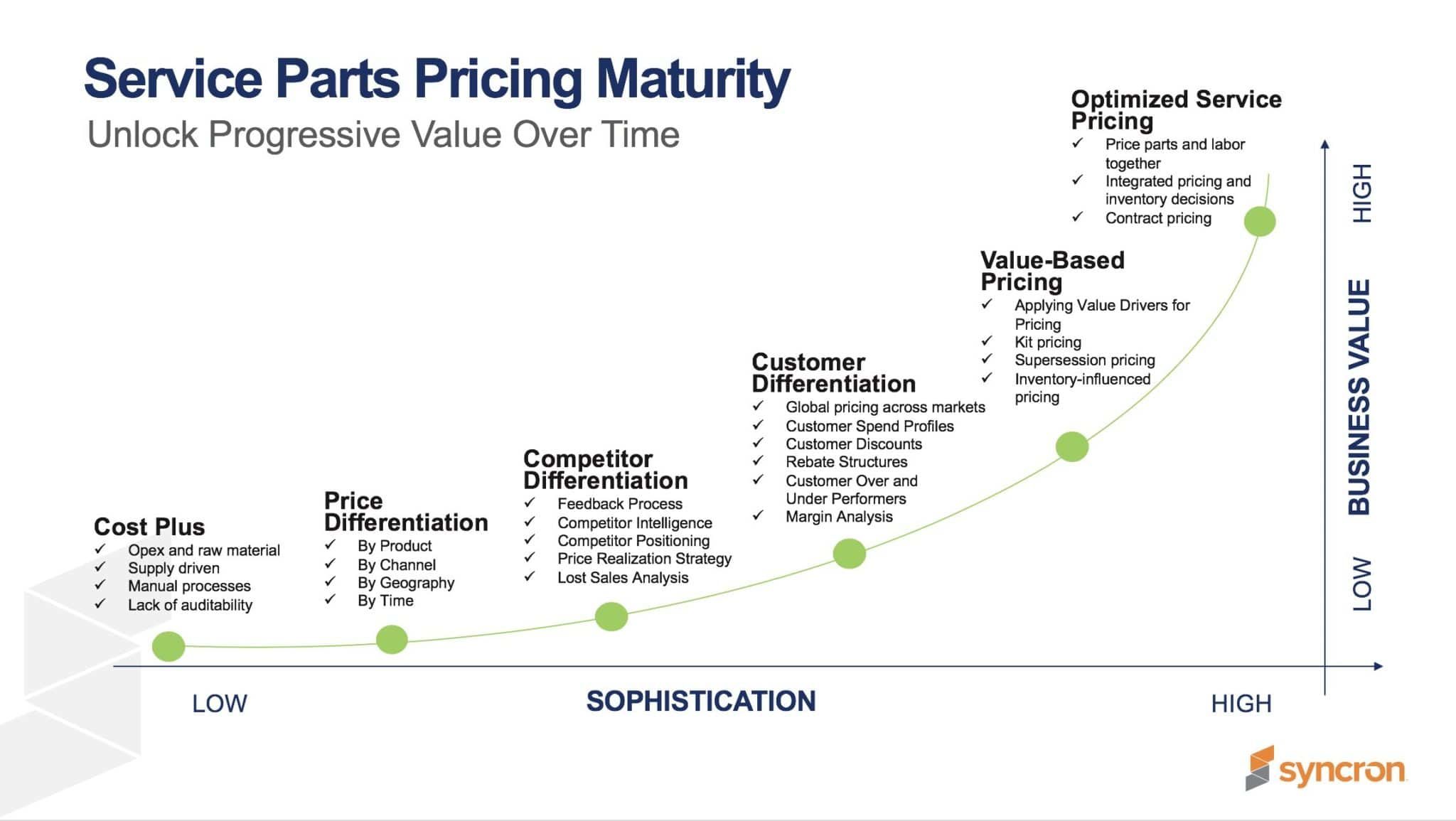

Pricing strategy can easily be plotted on a maturity curve, beginning with cost-plus pricing in the least mature state, followed by customer differentiated pricing, aftermarket specific pricing and competitive pricing, with value-based pricing ultimately leading to optimized service pricing, the highest level of pricing maturity. While this curve does provide demarcations of pricing maturity stages, it doesn’t exist in a single stream.

Despite any given pricing organization’s overall maturity, there will always be segmentations of price that lend themselves to either end of the spectrum. So, with the aforementioned complexities, along with a range of segmentations and approaches, how can OEMs balance different levels of service parts pricing maturity, simultaneously?

Segmentation in the Service Parts Pricing Maturity Curve

As mentioned above, the service parts pricing maturity curve isn’t necessarily a one way road. It does, however, provide different pricing techniques available depending on the segmentation situation OEMs need to follow for each of their unique items. That being said, there are all kinds of segmentation strategies – with different categorizations, like the following:

- Captive items, where the OEM is the only producer for these items, which may be slow-moving because they consist of complex parts like main boards creating a value-based pricing scenario.

- Commercial items, where items are purchased from a supplier, that have high sales because of frequent repricing or infrequent purchasing with regular maintenance like industry-specific equipment (think: mining parts) which are also best suited for value-based pricing.

- Bulk items, which may be optimal for continued cost-plus pricing, like screws, splints, nuts, etc.

Or, say an OEM is selling the power of a motor where the value to the customer is articulated via measurements like kilowatts – in this case, a value-based approach would be optimal for items with a value difference that can be easily understood by the customer. Pricing maturity is really just a question of finding the right segmentation strategy for unique parts and executing pricing strategies on that part individually.

Balancing Multiple Pricing Approaches Simultaneously

True pricing maturity is all about balancing multiple different pricing approaches at once. That’s when it becomes about identifying what kind of customer groups could OEMs can segment to differentiate pricing approaches in an intelligent way, for example:

- With a competitive pricing approach, OEMs can take a strategic price positioning, checking for competition and competitive data in the system.

- With a value-based pricing approach, the OEM would next check for value drivers in the system in order to apply the right price.

- And, with customer differentiation, the OEM will obviously segment by different kinds of customers – be it dealers or, in the case of industrial equipment or aircrafts, the end-customer.

Of course, for each of these different types of pricing methods, the OEM should always have costs and margin in mind. Say during competitive pricing comparisons, a competitor makes a pricing mistake – mistakes and errors of the competition can have a big impact on OEMs’ profitability.

That’s why the best pricing solutions automatically check for minimum margin, safeguarding the OEM each step of the way. This way, competitive pricing, value-based pricing and even cost-plus pricing can all be used within one equation – comparing the price positioning of competition to value drivers – and the system can then decide to go in a myriad of ways. It just takes the right pricing solution to achieve this blend of approaches seamlessly.

Where Can Pricing Organizations Aim to Go From Here?

Value-based pricing on the service parts pricing maturity curve can be quite resource intensive, but even an OEM with limited resources – say one or two full-time pricers – can still achieve advanced pricing maturity. They would just need to start off with a value assessment, focusing on parts with the most readily-available information and from there, they could define what value is actually being delivered to the customer. And, by starting off simply, discovering what areas have the most competition and what areas need addressing first, they’ll already be starting off on the right foot.

Ultimately, service parts pricing maturity is achieved through a crawl-walk-run approach, and by starting with the low-hanging fruit first, that’s what’s going to help gain momentum within the rest of the organization. And, as the team discovers more sophisticated ways of approaching pricing as a whole, that motivation can seep into other areas of the organization – but, it all starts by taking it slowly, making incremental changes to the process to learn more and more every day.

–

Interested in learning more about how to start your journey toward a better pricing process for your organization? Reach out to us today to speak to an expert about how you can get started with an intelligent pricing solution that meets the needs of your business today and will evolve with you into the future.