Welcome back to the final installment in this series on price segmentation, optimizing returns. If you missed part one and part two, be sure to read them first to get up to speed. (We’ll wait.)

Picking up where we left off last time, we covered the three most common ways to structure segmentation. Now let’s look at how you can use them together to get the best outcomes.

Bringing it all together

With each of the three structures having its advantages and disadvantages, we recommend using a combined approach. Let’s look at an example of how you can do this.

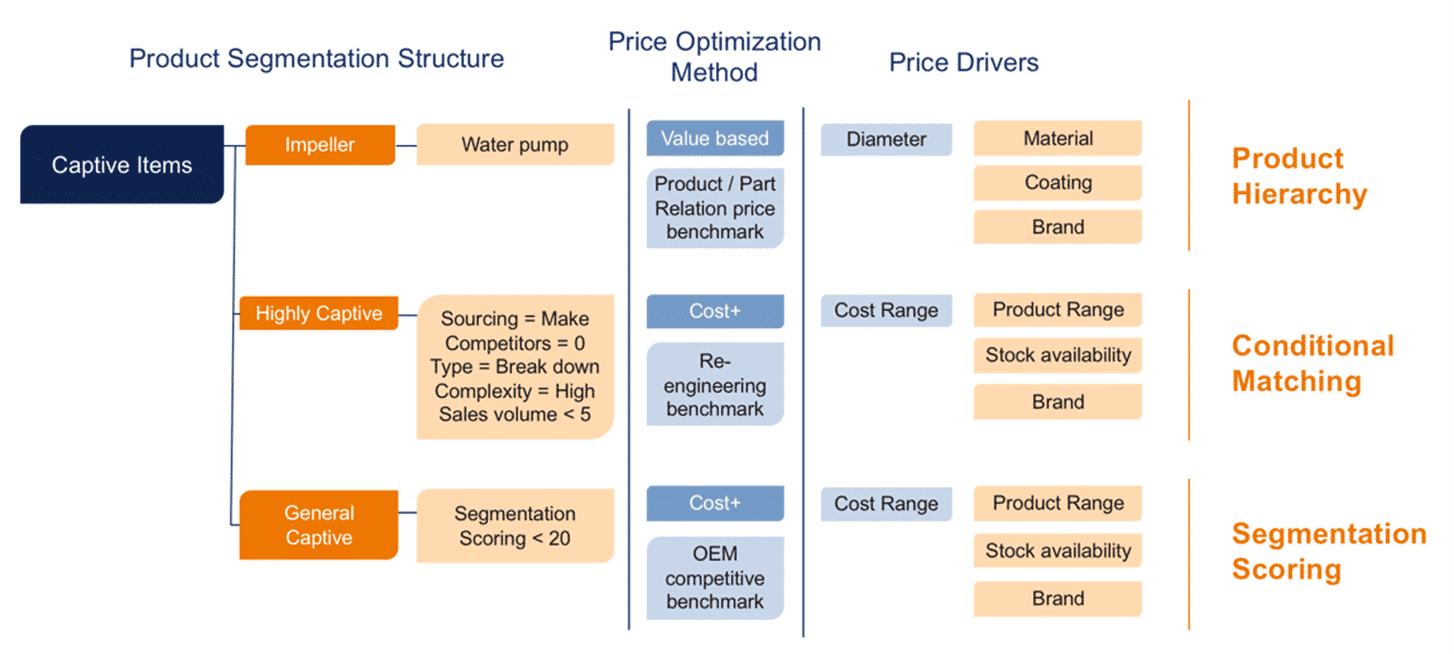

For a product that’s a big part of your business, such as an impeller for a water pump, you can use the product hierarchy structure. You should have the data to use value-based pricing driven by the product details – for example, diameter, material, coating, and brand. For highly captive items, which may make up the bulk of your catalog, you can use conditional matching with a cost-plus pricing method driven by things like availability and brand. And then for the parts where you have less data, you can use segmentation scoring. It’s broader and more efficient when information isn’t easily available or reliable.

Finding a happy medium

Combining structures will help you find the right balance between your level of segmentation detail and your organizational capabilities. Based on your company need for segmentation refinement, you might want to leverage the product segmentation given from engineering, if you have that ability, as well as any commercial supplier information that’s available from your purchasing department. You want to map it against any master data available from pricing and adapt your ambitions based on current data availability. For the bulk of your products, consider using a segmentation scoring to easily manage and price your items in the most resource effective manner.

You also need to think about your organization’s ability to gather and structure parts data such as technical price drivers and competitive information. If you don’t have the ability to get that data, there’s no point in attempting to go to that level of detail. Assess your abilities honestly and work with what you have. As a rule of thumb, one full-time employee (FTE) or equivalent that’s responsible for pricing can manage roughly 100 segments, depending on their skillset. So, if you want to manage 500 different segments, you’ll need five people to do that well.

Local market segmentation

You may also need to take local needs into account – which may differ from standard segmentation. For example, take an electronic component that’s made by a supplier that’s based on the continent but doesn’t have any presence in North or South America, Asia, Australia, or Africa. That item might be considered commercial in Europe, where it’s probably available from various sales offices. But in the US or Latin American it would be very hard to find. In those markets it’s considered captive.

It’s important to maintain local segmentation if it impacts your business significantly. These factors are often commercially driven on the supplier side, so you need to understand the regional organizations and think about how their abilities impact pricing. If a supplier can’t deliver to your region, can you source alternatives from local suppliers? You might also need to use a different pricing methodology depending on the approach—for example, a competitive pricing approach rather than value-based. And of course, maintaining local segmentation also depends on your organization’s ability and skillset.

Summing it all up

Let’s finish up with a quick recap of the key takeaways from this series. Product segmentation can help OEMs identify over- and underpriced items and capture unrealized margin potential. A number of different pricing methods can be applied, depending on your commercial situation and the data that’s available to you. There are three main segmentation structures: Product hierarchy segmentation is best for value-based pricing approaches and homogeneous segments with relatively given commercial conditions. Conditional matching strategies are recommended for segments driven by clear commercial conditions across product groups. And segmentation calculation is very effective for pricing the bulk of your items, where you might not have a lot of data or just need a simpler approach. A combination of all three often works best. We also recommend local market segmentation if you have a clear commercial need. Look at it from every angle and remember, there’s no one-size-fits-all method – you have to figure out what works for your organization.

Ready to see what Syncron Price™ can do for your pricing strategy? Our Profit Discovery Program is a fantastic way to get started.