Welcome back! If you missed part one of this series, you can read it here. Be sure to check out our recent Back to Basics posts, too, where we covered the fundamentals of pricing – price optimization; inventory optimization (part one and part two); and retail inventory management or RIM (part one and part two). Now, let’s continue our conversation about next-level price tactics.

Pricing strategies and product lifecycle stage

Combining inventory levels with remaining lifespan allows OEMs to execute yield-based pricing for specific parts or groups of parts. You can employ various analytical strategies to measure lifecycle stage, leveraging a number of attributes or variables depending on your data. For new items, we typically look at the born-on date or when it was first used in production. First use can actually be more telling because many new parts don’t face competition until 6-12 months after production. Simply look at duration since birth and assume that in that first time period, there wasn’t much competition—because all parts are under warranty and the aftermarket is still trying to develop alternatives.

To determine the end of life, look at how much time has passed since a part’s last use in production and then forecast out the number of years it will be in demand based on the expected lifespan of the vehicle or machine it’s used in. After the initial bulk production, sporadic hits on a specific part over time can distort or reset this timer, making it difficult to define last use. We try to look at the Pareto of production, choose a point at the top and determine that to be the point it was last used in production. This can be especially complicated for automotive companies that use one part in many different models. You may have to take the last used in production point on the latest model, and forecast out from there.

Understanding demand: Yield-based pricing

Once you’ve assigned lifecycle stages, you can use this information to support yield-based pricing and maximize revenue. Identify parts that are at the end of their life with a lot of stock still on hand. You will likely want to do an end of life liquidation with a low margin or price so you don’t get stuck with a large quantity of inventory that you’ll eventually have to scrap. Conversely, you may have parts that are at the end of their life but with limited stock on hand. In this case, offering an all-time buy might be beneficial. You definitely want to drive the price or margins up to maximize profitability on the finite amount of stock you have left.

The key to successful yield-based pricing is building your model on a live data field so you can continuously monitor when parts change lifecycle stage or inventory position, triggering a pricing action. And this is true for all aspects of segmentation—it has to be dynamic and evolving over time.

Customer segmentation and net pricing

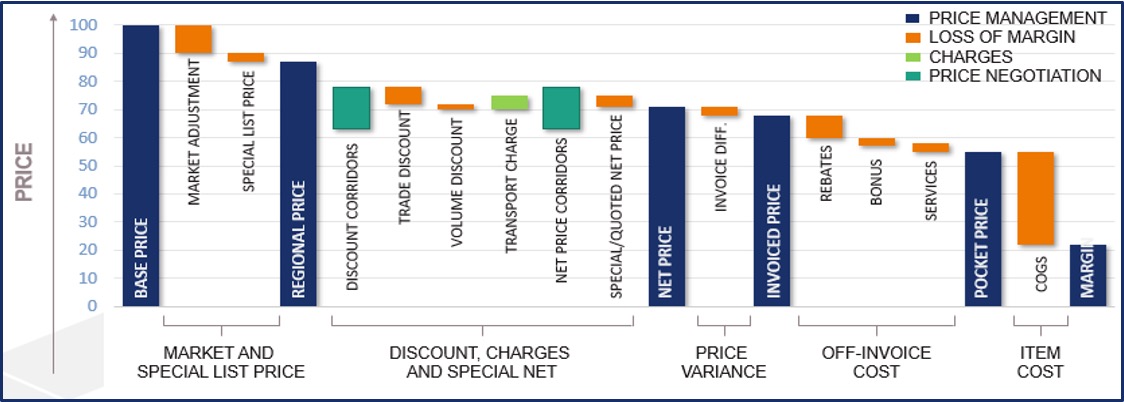

Returning to the price waterfall model we talked about last week, let’s look at how you can segment customers to control net pricing across multiple markets and product lines. The distribution strategy for global OEMs typically includes various channels along the value chain such as dealers, service centers, distributors, and e-commerce platforms. It’s important to differentiate customer discount structures by value to improve your overall bottom line.

The price waterfall model can also be used to differentiate customers and control net pricing.

The first step is to define your strategy. Before you can do anything at the customer level, you need to evaluate profitability within each channel and decide strategically where you want to play. Consider which channels are going to be most important to your business, both currently and in the longer term, and then work to build a discount structure that pushes business and volume into those channels.

After you model and create simulations here, you may need to manipulate your pricing to meet your goals. This includes making unfavorable changes to discounts on certain channels in order to direct business towards the channels that you’ve decided are more important overall. Simulating these changes will require some complex modeling, but it’s vital that you do so. Once you’ve decided what you want to do at a channel level, you can focus down to the customer level, determining how to segment and build your net pricing structure.

Customer-level strategies can vary widely. Most companies that sell through a dealer channel want them all to buy and sell at the same price to avoid creating gray market and arbitrage opportunities, where dealers compete against each other. (More on this next week.) But many build bonuses and rebates into the terms and conditions, which helps promote loyalty and boost volume. On the other hand, companies selling primarily to end customers or rental houses will often build in customer-based discount tiers that are associated with volume—annual spend on either parts or machines. These discounts are strategically placed at levels that will encourage or incentivize customers to grow their spend and reach the next tier. This approach also involves a good deal of modeling and simulation. The bottom line is that powerful analytics are key to identifying customer segmentation challenges as well as defining future strategies.

Next week we’ll bring you the final post in this series, where we’ll talk about pricing for campaigns and promotions, and price harmonization—an important topic in many regions. Until then, if you’re looking to increase your margins and boost profits, check out our new Profit Discovery Program. Want to learn more about Carlisle & Company? Email [email protected] or visit Carlisle & Company’s website.